Pre-risk surveys are necessary for identifying the hazards that may adversely impact a property and business, and to determine the effectiveness of the control measures in place to deal with those hazards. Within an insurance context, pre-risk surveys are relied upon to understand the exposure to different types of risks and to help decide whether these risks fall within the risk appetite of the insurer. Pre-risk surveys are also critical so underwriters to determine the frequency and severity of a given risk so that they may adequately decide the terms and conditions of cover.

When instructed to perform a pre-risk survey, our experts not only provide documentation of the risk and exposure to different perils, but also perform a risk analysis that can be used by underwriters and insurance managers to fully understand the impact and the consequences of the risk. More importantly, our experts provide sufficient information to allow underwriters and insurance managers alike to evaluate the effectiveness and efficiency of the control measures already in place.

When instructed to perform a pre-risk survey, our experts not only provide documentation of the risk and exposure to different perils, but also perform a risk analysis that can be used by underwriters and insurance managers to fully understand the impact and the consequences of the risk. More importantly, our experts provide sufficient information to allow underwriters and insurance managers alike to evaluate the effectiveness and efficiency of the control measures already in place.

Our pre-risk surveys follow a process rooted in a comprehensive understanding of risk management, insurance and engineering principles. This process involves many steps, including:

- Hosting meetings with the insured managers and employees to ascertain the processes in place and to facilitate understanding of the operational models used in production of goods and services.

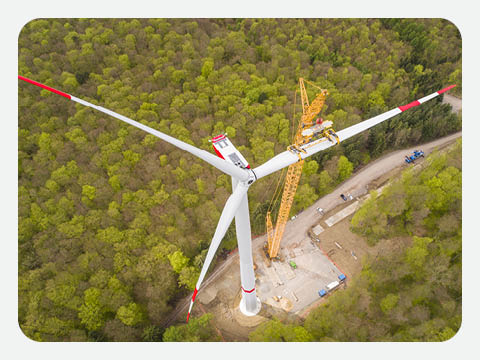

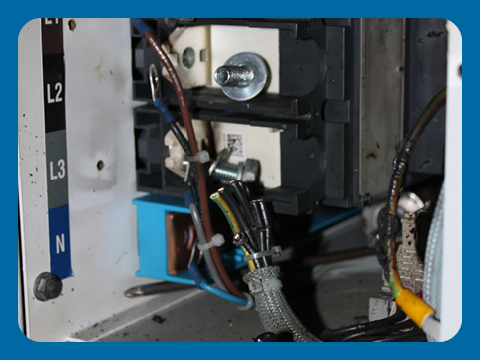

- Thoroughly inspecting the property and documenting its condition, in order to produce an accurate report that will guarantee the insured's thorough understanding of all risks.

- Closely examining critical systems and components to determine their condition and to understand the risks associated with operation and maintenance.

- Requesting and securing information that describes management and control processes.

- Preparing a comprehensive report providing complete risk analysis.

- Preparing a Risk Improvement Plan that can be utilised by insurers and insured alike to develop a process to enhance their risk profile.